In the same month that British Cycling called for the UK government to give cyclists tax breaks for commuting by bike, a petition is canvassing for riders to pay insurance.

British Cycling’s policy advisor – Chris Boardman, and Paralympian Dame Sarah Storey said last week that the UK government should give tax breaks to commuters and businesses’ encouraging cycling.

The proposals for tax breaks were put together by one of the country’s top tax experts – Jolyon Maugham QC – commissioned on behalf of the #ChooseCyclingBusinessNetwork.

Proposals include £250 for individuals who cycle to work, plus £100,000 for businesses’ that invest in cycling, and an expansion of the Cycle to Work scheme to benefit self-employed people.

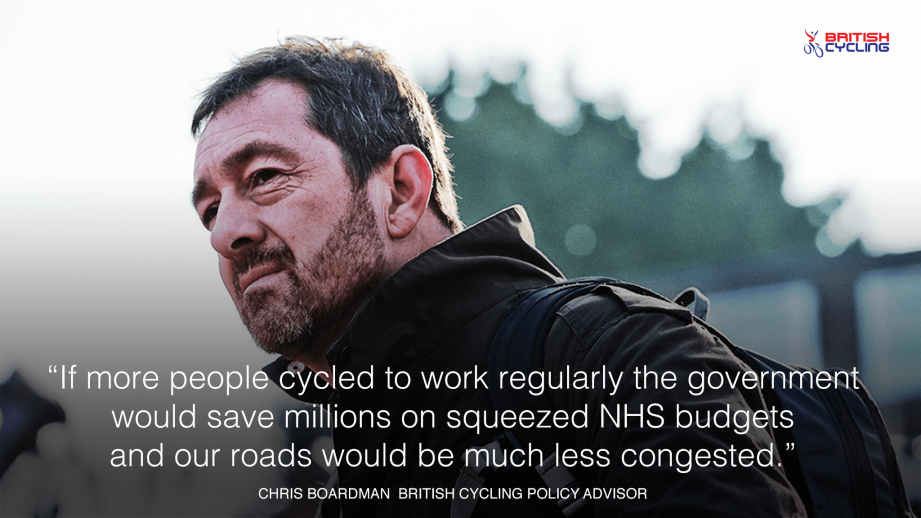

British Cycling’s policy adviser, Chris Boardman, supported the suggestions commenting: “If more people cycled to work regularly the government would save millions on squeezed NHS budgets and our roads would be much less congested. That in itself would more than pay for a £250 tax break and would provide a real incentive for people to live more active lives.”

As well as saving the NHS money, stats from Cyclescheme.co.uk state that £83 million is saved annually by cycle commuters taking one day less off sick each year and that 44,000 tonnes of CO2 would be saved each week if all 5 mile commutes in England were made by bike.

Dame Sarah Storey commented on the tax break suggestions, saying: “Britain’s businesses have woken up to the benefits that cycling can bring to their employees and it’s about time that the government followed suit. It’s only right that if a company invests heavily in providing high quality changing and bike storage facilities – things that will help our nation become healthier and fitter – that they should get a tax incentive for it.”